PLEASANTON, CA--(Marketwired - Sep 4, 2014) - Workday, Inc. (NYSE: WDAY), a leader in enterprise cloud applications for human resources and finance, today unveiled Composite Reporting, a new tool that advances the breadth and depth of functionality in Workday Financial Management for large organizations. Designed in partnership with customers, including CEC Entertainment, Life Time Fitness, and Netflix, Composite Reporting transforms the way finance teams build, interact with, and deploy multi-dimensional financial and operational reports directly in Workday by merging the familiarity and flexibility of a spreadsheet with enterprise-grade performance and security.

In addition to Composite Reporting, Workday also announced the availability of new features that deepen the value of Workday Financial Management for industry verticals, including financial services; software and internet services; and education, government, and non-profit.

Composite Reporting and industry-specific capabilities for finance are available as part of the company's latest release, Workday 23, which also includes new features for Workday Human Capital Management (HCM) and Workday Student. The new features are all delivered to customers via continuous development on a single code line.

The New Standard for Financial Reporting

Spreadsheets are among the most ubiquitous tools in corporate finance but require considerable time to create, manage, reconcile, and control. To develop board-ready reports, finance teams have traditionally had to extract data from multiple systems, and then consolidate and format a series of spreadsheets into one static and stand-alone report. This manual process is tedious, inefficient, and creates risks in organizations already facing increased scrutiny in a highly regulated environment.

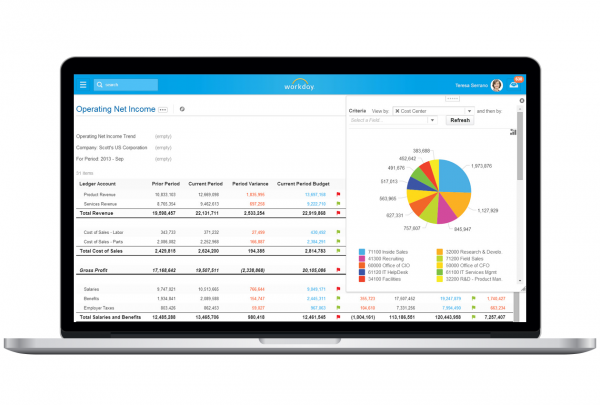

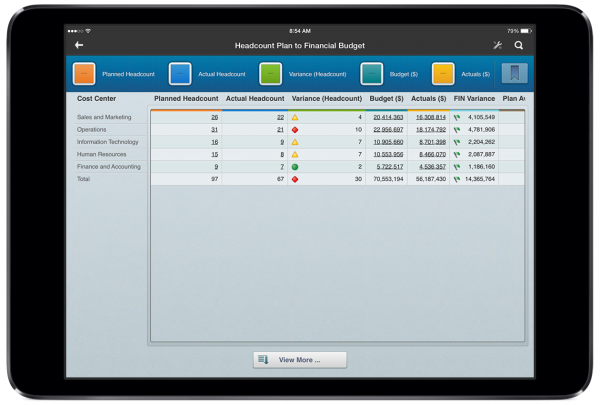

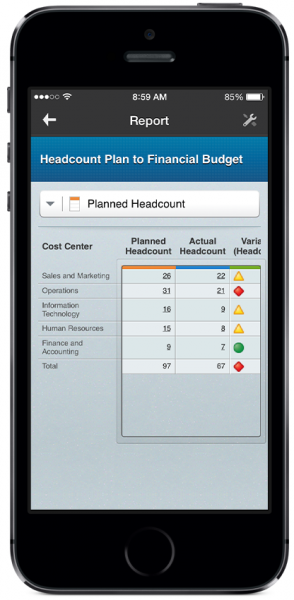

With this in mind, Workday developed Composite Reporting, which enables customers to combine various data sources such as actuals, budgets, statistics, and headcount, into live multi-dimensional reports that users can format, drill down into, and act on all within Workday. As a result, corporate finance teams are able to build reports such as a balance sheet, income statement, or cash flow statement in a fraction of the time and effort required with traditional, legacy systems. Furthermore, because Workday is a unified system, Composite Reporting scales across the enterprise so organizational leaders outside of the finance team can build unique reports for their part of the business, such as a division manager running a profit and loss (P&L) statement for his or her business review.

Additionally, with Composite Reporting, Workday Financial Management customers will benefit from:

- The Power of One Application: Built on Workday's native, in-memory architecture, customers can combine multiple data sources and run complex financial reports in real-time without the need for a separate business intelligence tool or data warehouse. As a result, organizations will be able to operate from a single source of truth, no longer relying on manual reconciliation to ensure data integrity.

- Interactive and Configurable Reports: With design elements similar to a spreadsheet, such as a grid layout, conditional formatting, and the ability to insert formulas and calculations, customers are able to easily configure columns, rows, and cells as well as overall report formatting. Additionally, with drill down capabilities, users can click on cells to gain better visibility into numbers and underlying transactions. This is enabled by Worktags, which allow users to configure reports with multiple dimensions, such as time, region, department, customer, or any Worktag meaningful to their reporting needs.

- Improved Security and Accessibility: Composite Reporting puts control back into the hands of finance professionals who can select which employees and managers can access the report. Once a user is given privileges, he or she can view and take action, such as preparing and presenting a board-ready reporting package including financial statements, analytics, and visuals from a desktop or any mobile device.

Delivering on Industry-Specific Needs

With its latest release, Workday continues to deliver new features and enhanced functionality in Workday Financial Management to meet industry-specific requirements, including:

- Financial Services: Workday has advanced the breadth of financial management functionality for banking, insurance, and diversified financial services companies to meet industry reporting requirements. For example, these organizations can now select which books, accounts, and Worktags should be included to calculate and report the average daily balance.

- Software and Internet Services: Workday has added features to help organizations better manage complex revenue models and more quickly respond to new revenue recognition requirements. With Workday, organizations can now auto-generate a revenue recognition schedule when submitting a customer contract, or they can quickly compute fair value revenue allocation to support customer contracts with multiple elements, including software licenses and billable professional services.

- Education, Government, and Non-Profit: Workday continues to equip organizations with capabilities to keep up with increased scrutiny and regulation on their use of funds. Customers will now have greater flexibility in managing funds with the grants Worktag. For example, Workday provides the ability to allocate different types of costs to various entities and grants.

Comments on the News

"Workday Financial Management is not only redefining how organizations run financials in the cloud, but helping redefine how they run their financials teams entirely with a solution that is easier, faster, and smarter. We realize that every business and industry has unique requirements, and it's no longer enough to develop tools that meet today's business needs -- our goal is to anticipate and solve tomorrow's problems," said Betsy Bland, vice president, financial management products, Workday. "Workday Composite Reporting is changing the game. Gone are the weekends of pulling together financial binders. Corporate finance teams will now have time and control back in their hands with a solution that enables them to prepare and distribute their financial reports all in one system."

"Composite Reporting is one of the most significant developments we've seen in Workday Financial Management to date," said Brian Fisher, director, accounting technology, Life Time Fitness. "With the launch of this new feature, we are able to fully leverage all the benefits of one unified system with Workday -- including in-memory, real-time access, and Worktags -- to consolidate financial, payroll, and HR data into a single, multi-dimensional report. Ultimately, Composite Reporting helps users eliminate time otherwise spent manually combing through multiple sets of data in order to create reports that provide an accurate view of the business."

"Traditionally, operational managers have had to spend hours creating reports manually that combine data from multiple sources and have inherent risk. Concerns over bad data, security and auditing have created headaches for organizations," said Christine Dover, research director, enterprise applications and digital commerce, IDC. "Workday's Composite Reporting is designed to address these problems and will allow organizations to eliminate manual tasks so they can focus more on strategic decision making."

Additional Information

Please visit the Workday blog for additional perspective on the news, including:

- Next-Generation Financial Reporting in Workday 23: It's Time to Burn the Binder, from Betsy Bland, vice president, financial management products, Workday

- 5 Ways Continuous Development Benefits Workday Customers, from Mike Frandsen, senior vice president, products, Workday

About Workday

Workday is a leading provider of enterprise cloud applications for human resources and finance. Founded in 2005, Workday delivers human capital management, financial management, and analytics applications designed for the world's largest companies, educational institutions, and government agencies. Hundreds of organizations, ranging from medium-sized businesses to Fortune 50 enterprises, have selected Workday.

Forward-Looking Statements

This press release contains forward-looking statements including, among other things, statements regarding the expected performance and benefits of Workday's offerings. The words "believe," "may," "will," "plan," "expect," and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to risks, uncertainties, and assumptions. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Risks include, but are not limited to, risks described in our filings with the Securities and Exchange Commission (SEC), including our Form 10-Q for the quarter ended July 31, 2014 and our future reports that we may file with the SEC from time to time, which could cause actual results to vary from expectations. Workday assumes no obligation to, and does not currently intend to, update any such forward-looking statements after the date of this release.

Any unreleased services, features, or functions referenced in this document, our website or other press releases or public statements that are not currently available are subject to change at Workday's discretion and may not be delivered as planned or at all. Customers who purchase Workday, Inc. services should make their purchase decisions based upon services, features and functions that are currently available.

© 2014. Workday, Inc. All rights reserved. Workday and the Workday logo are registered trademarks of Workday, Inc.

Contact Information:

Media Contact

Nina Oestlien

Workday

+1 (415) 432-3041

nina.oestlien@workday.com